- The US has the highest number of ultra-high net worth individuals.

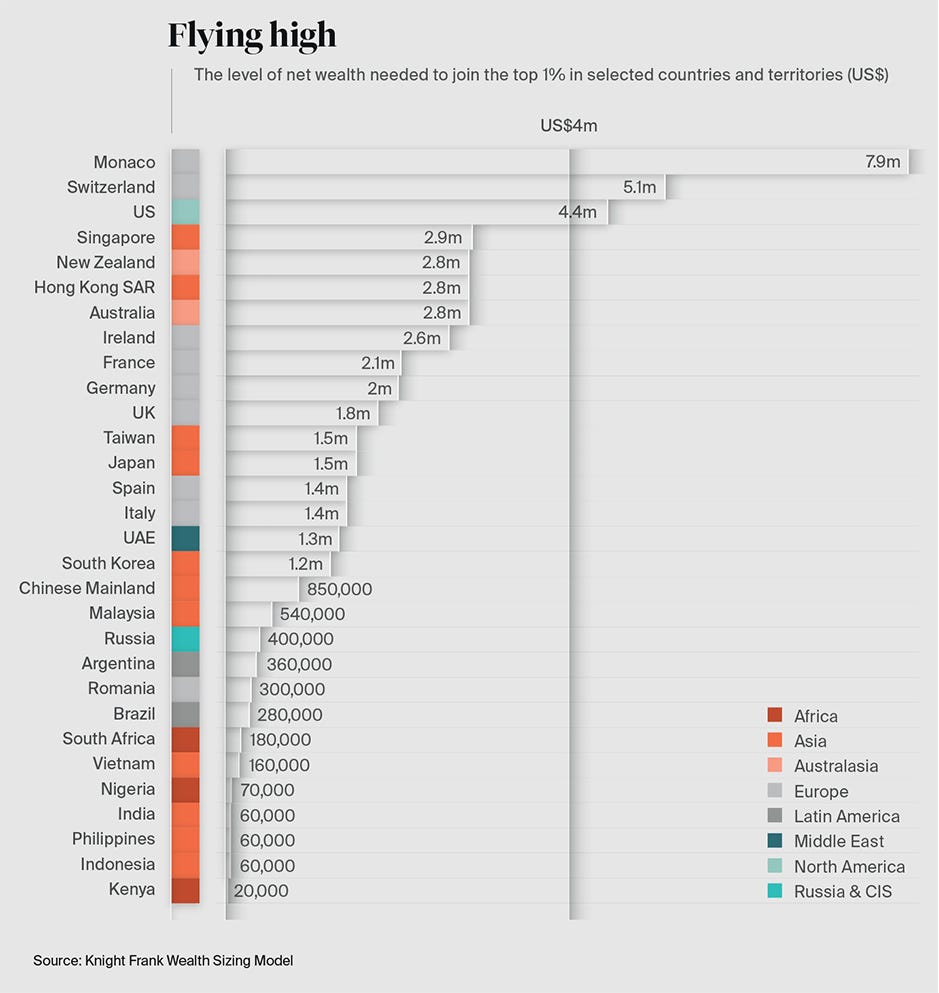

- You need $4.4 million in the US to be in the richest 1%, according to the 2021 Knight Frank Wealth Report.

- Monaco had the highest barrier to entry, requiring $7.9 million to crack into the 1%.

- Visit the Business section of Insider for more stories.

Curious to know what the cutoff is to be in the wealthiest 1%? The new annual Wealth Report from Knight Frank breaks the numbers down for the US and other countries around the world.

An individual in the US needs a net wealth of $4.4 million to be among the richest 1% in the world, according to the Knight Frank 2021 Wealth Report. Compared to the rest of the world, the US has the third-highest wealth threshold to break into the 1%.

However, the US has the highest number of what Knight Frank calls UHNWI residents – ultra-high net worth individuals. The real-estate consultancy firm defines a UHNWI resident as someone whose net wealth exceeds $30 million.

Switzerland has the second-highest wealth threshold, with a person needing $5.1 million to join the richest 1%.

Monaco – where the densest population of the super-rich reside according to Knight Frank- has the highest mark to hit for the 1%: $7.9 million.

Courtesy of Knight Frank

Others listed in the report included No. 4 Singapore at $2.9 million, positioning it as Asia's highest entry ahead of Hong Kong, which requires a net wealth of $2.8 million. The highest entry to the richest 1% for Latin America is Argentina at $360,000. South Africa has the highest wealth threshold out of any other country in Africa, at $180,000.

Countries with the lowest wealth thresholds to crack into the 1% include Indonesia, where a person needs $60,000, and Kenya, where a net wealth of $20,000 is needed for that status.

The report predicts that India's 1% threshold will almost double within the next five years and increase by about 70% for the Chinese Mainland from $850,000 in 2020.

Around 90% of respondents polled in the Knight Frank's Wealth Report Attitudes Survey said they see investment opportunities after the Coronavirus pandemic.

"We are entering a new economic cycle and the prospects for wealth creation and growth are huge," David Bailin, Chief Investment Officer at Citi Private Bank, told Knight Frank.